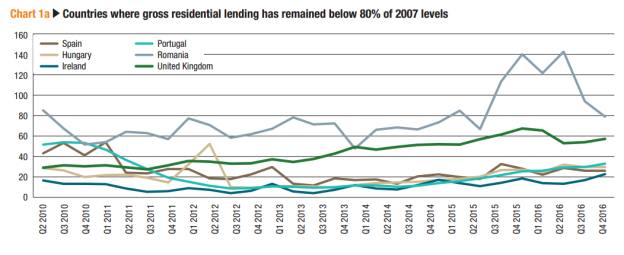

The same trends appear in many other European countries, to varying degrees.

Since the credit crisis, regulatory changes in major economies over how much money banks and building societies must maintain as a capital buffer, as well as more stringent checks imposed on banks when it comes to lending, and it is not unreasonable to suggest there is a tougher environment for all borrowers, not least those looking to move overseas.

Stuart Marshall, managing director of Liquid Expat, says despite the credit crunch and subsequent bank tightening, his firm has seen steady business growth.

He avers: "We have noticed an increase in demand for cross-border mortgages over the past decade. This has led to the introduction of more lenders in the market and ultimately more options available for clients who require cross-border mortgage finance."

Data from his firm suggests Liquid Expat has seen the number of lenders willing to accept a mortgage application rise from 20 up to 35 on the approved panel over the past five years.

Moreover, on a buy-to-let basis for an expat application using a UK property as collateral for a mortgage, Liquid Expat can secure up to 75 per cent Loan to Value and up to 90 per cent for a main residential property for the owner/immediate family.

This is a sign the market has been healthy over the past decade, rather than declining as a result of the credit crisis.

Possible downturn

So the past decade may not have had that much of an impact, but what about the next few years?

Given the uncertainty over Brexit, the volatility of sterling and the concern over what will happen to freedom of movement across Europe, could we start to see an ebb in the tide of trans-continental property purchases?

Mark Posniak, managing director for Octane Capital, is of the view this more restrictive environment is generally not great for mortgage borrowers looking to buy overseas.

He says: “More regulation in the market has resulted in a reduction in lenders willing to offer finance to borrowers purchasing abroad.

“Even those that do often want assets under management before they will even consider a mortgage.”

This is especially so on the continent, experts believe. Mr Howarth comments: "It has been a volatile time for Europe economically over the past 10 years.

"Bank liquidity became scarce following the 2007 financial crisis for key members of the EU, the exchange rate is volatile, and there are a number of political uncertainties across Europe - including Brexit."

But it is not all gloom, he adds.

"International property investment has endured, and international non-resident's banks have made painstaking efforts to hold back liquidity to lend to non residents."